How Credit Reporting Works - Credit Roadrunner Credit Repair

Why have you been denied when applying for a new loan or a credit card?

Why when you are getting approved, you’re getting interest rates of 20% or higher?

Credit Roadrunner will educate you and help understand how to stay on track as long as you are a valued client.

Credit means receiving something of value upfront with a promise to pay for it later, usually with a finance charge added by the lender.

Consumers all over the world use credit to buy almost everything, including food, clothing, housing, and transportation. Unfortunately, many people struggle to control their use of credit and get overwhelmed by piles of bills for various reasons, and sometimes those reasons are out of our control. At Credit Roadrunner credit repair, we believe knowledge is power and we want to share it with you!

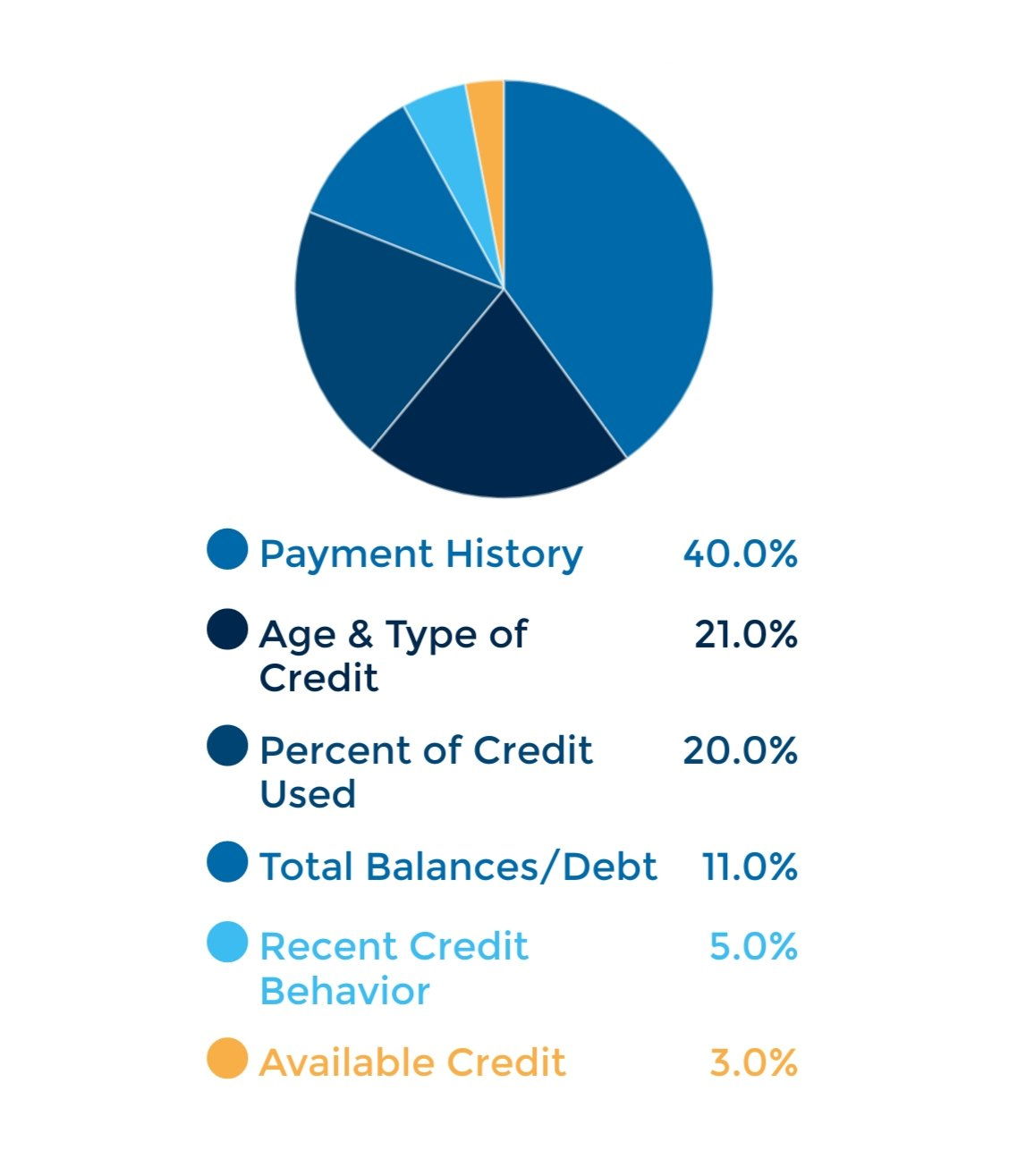

Here is a chart that helps explain how your credit score is calculated.

The most important factor and what makes up for 35% of how your score is determined, is payment history. It’s imperative to pay your credit accounts of all types on time.

If you've missed a payment on one of your credit accounts, the late payment will be reported to the credit bureaus 30 days past the due date and get progressively worse with each day the payment has not been made.

Paying payments late will also almost always come with penalties or fees usually starting after being ten days late and getting greater after 30 days.

If you have never been late before or have a good excuse and history, you can usually contact the creditor and ask for forgiveness and a refund on the fees. Unfortunately, the reporting of late payments even if it’s the first time usually cannot be removed through a normal process.

Credit Roadrunner can help you get these items deleted!

The second most important factor that helps determine your credit score is the amount of money you owe vs your available balances, aka Credit Utilization.

Credit Utilization works like this: the amounts owed on accounts totaled together as a whole divided by your credit lines.

This includes but is not limited to:

How your credit score is calculated

The good credit utilization ratio is less than 30 percent. That means you're using less than 30 percent of the total credit available to you.

As an example, on a credit card with a $1,000 limit to have acceptable utilization, you would need to keep your balance at $300. Your credit score drops as your credit card balances rise above that threshold.

The third most important factor that is considered when calculating your credit score is the length of credit history, this is determined by the length of the longest open credit account you have. The lengthier your credit history the more helpful it is to your credit score.

You may have credit card accounts that you want to close for some reason but, if it’s one of your long-standing accounts you may want to reconsider.

If you are new to establishing credit you may consider asking a “responsible” friend or family member to add you to one of their long-standing credit accounts.

You will be able to share the positive credit history from that account. Keep in mind; if you become an authorized user on their account, their credit utilization will be reflected on your account.

Using Credit Roadrunner is an excellent choice for individuals looking to fix and improve their credit scores, especially with its holistic approach that goes beyond traditional credit repair services. Credit Roadrunner not only provides expert assistance in disputing negative items and inaccuracies on your credit report but also offers in-depth credit counseling to empower clients to maintain good credit habits for the future. Here’s a breakdown of why choosing Credit Roadrunner can be a transformative decision for your financial life.

A strong credit score is the gateway to countless financial opportunities, from better loan terms to increased access to lines of credit. Negative items on your credit report can impact your score, resulting in higher interest rates, lower loan approvals, and restrictions on housing and employment opportunities. But credit repair can be a complex process, and without expert guidance, many people struggle to make lasting improvements.

A strong credit score is the gateway to countless financial opportunities, from better loan terms to increased access to lines of credit. Negative items on your credit report can impact your score, resulting in higher interest rates, lower loan approvals, and restrictions on housing and employment opportunities. But credit repair can be a complex process, and without expert guidance, many people struggle to make lasting improvements.

Why Credit Roadrunner Stands Out

Credit Roadrunner distinguishes itself by providing not just credit repair but a comprehensive path toward financial improvement. Our focus on education, customer support, and long-term credit health ensures clients are equipped to make informed financial decisions well into the future. Here are some key reasons why Credit Roadrunner credit repair is the right partner to help you repair and maintain a good credit score.

Understanding the Importance of Credit Repair

1

Expert Dispute Handling and Accuracy Checks

Credit reports often contain errors—from incorrect addresses to duplicate accounts or misreported late payments. Credit Roadrunner's team has the expertise to identify these inaccuracies and initiate disputes on your behalf. We work directly with credit bureaus and creditors to challenge and resolve these errors, helping remove obstacles to a higher credit score. We will Dispute items on your Equifax, TransUnion, and Experian credit reports. Our team also knows how to navigate complex cases involving collections, charge-offs, repossessions, and even foreclosures, tackling each issue with a tailored strategy. We will continue to monitor your credit with our credit monitoring software

Comprehensive Credit Counseling

One of the most valuable components of Credit Roadrunner's services is our commitment to client education. Many individuals may find themselves in poor credit situations due to a lack of understanding about credit’s impact or the best ways to manage it. Through credit counseling, we provide detailed advice on the do’s and don’ts of credit management, helping clients learn how to establish better credit habits, reduce unnecessary expenses, and set achievable financial goals.

2

Our counselors cover topics like:

- How to avoid late payments: Setting up reminders and auto-payments to prevent missed deadlines.

- Maintaining credit utilization ratios: Understanding the importance of keeping balances low relative to credit limits.

- Understanding the impact of credit inquiries: Recognizing when to avoid unnecessary credit checks that can lower your score.

- Managing accounts responsibly: Knowing when to open or close accounts for optimal impact on your score.

This guidance equips clients with the tools they need to build a strong, sustainable credit foundation. We’re not just helping repair credit but enabling clients to maintain it by making smarter financial choices.

Personalized Credit Repair Plans

Every client’s financial situation is unique, and Credit Roadrunner acknowledges this by offering personalized credit repair plans. Our experts take the time to understand each client’s credit report, identify problem areas, and craft a customized approach to address specific issues. We break down the process into manageable steps, whether it’s disputing specific items, offering credit counseling, or creating a timeline for expected results. This tailored approach allows clients to see steady progress, which is essential for staying motivated and on track.

3

4

Nationwide Reach and Local Expertise

While Credit Roadrunner began as a local company in NYC, we’ve since grown to serve clients nationwide. This expansion means we bring the same high-quality service and expertise that established us as a top choice in New York City to clients across the country. Our nationwide reach allows us to work with individuals in diverse financial situations and regions, understanding local credit regulations and how they impact credit repair strategies.

Ongoing Monitoring and Support

Credit Repair is often a long-term process, and Credit Roadrunner is dedicated to supporting clients at every stage. We offer ongoing monitoring to help clients track their progress, celebrate their successes, and address any new challenges. This long-term partnership provides clients with peace of mind, knowing they have a dedicated team working with them and monitoring for any changes or new issues on their credit reports.

5

6

Building Financial Confidence and Knowledge

One of the most significant benefits of using Credit Roadrunner is the lasting knowledge clients gain through our educational resources. We believe that financial empowerment comes from understanding, and through credit counseling, clients learn critical skills that help them make wiser choices for years to come. This knowledge builds confidence, enabling clients to make sound financial decisions, avoid future credit issues, and ultimately reach their long-term goals—whether it’s buying a home, starting a business, or achieving financial independence.

Why Start Now?

The longer you wait to address credit issues, the longer they will impact your financial opportunities. Late payments, collections, and other negative items can continue to affect your score for years, making it harder to qualify for loans, credit cards, and other financial services. By taking action now, you’re investing in a future of financial security and opportunity.

The process of repairing credit can take time, but Credit Roadrunner ensures that you’re on the right path from the start. The sooner you begin, the sooner you’ll see results. Plus, with the knowledge and skills gained through our credit counseling program, you’ll be prepared to manage your credit responsibly and avoid future setbacks.

Credit Road Runner Credit Repair Looks Forward to Serving Your Credit Repair Needs!

Credit Roadrunner is more than a credit repair service; we’re a partner in your journey toward better credit health and financial empowerment. Through expert dispute handling, personalized credit repair plans, and ongoing credit counseling, we provide a complete solution for improving and maintaining a strong credit profile. Our team is committed to helping you reach your financial goals by tackling existing issues and teaching you how to manage your credit for the long haul.

Credit challenges can feel overwhelming, but you don’t have to face them alone. Credit Roadrunner is here to support you every step of the way, guiding you to a better credit score and a brighter financial future. Don’t wait—start your journey with us today and take the first step toward a lifetime of financial stability and opportunity.

“Click on” call 844-59-RUN63 / 844-597-8663 or email info@creditroadrunner.com for a free consultation!